JoinStampede creates online petition with over 25,649 signatures to take to private lenders and negotiate discounts, rebates, or modified interest rates

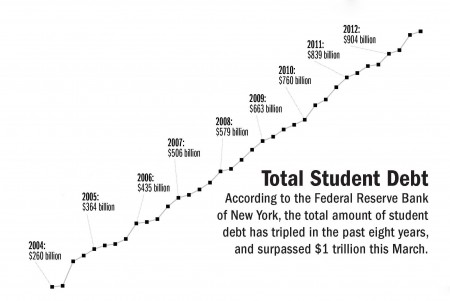

In the beginning of March, the student debt in America finally surpassed the long anticipated $1 trillion mark.

To help ease the burden of debt that now cripples 37 million Americans, a new campaign called JoinStampede is looking for the support of 100,000 people with student debt loans to sign their petition. JoinStampede hopes to be able to approach private lenders with the combined support of each signature to negotiate a discount, rebate or modified interest rates for student debts.

Mason alumnus Quincey Smith works for JoinStampede and said that the success of the campaign could potentially effect current Mason students with debt.

“What JoinStampede does expect to do is create a consumer movement using political style campaigning on the basis that when people band together, their collective voice has the potential to change the dynamics of the marketplace, and that businesses will be forced to adapt or be left behind,” Smith said in an email.

“We want to be in the same shoes as our members, this is a long-term interest,” Stephen Dash said, founder of JoinStampede. Students who seek out loans from private lenders must receive approval from the university certifying that they are full-time students.

“The private lender forwards the money to the school, then the school credits the student’s account,” Bob Smith said, assistant director of financial aid counseling. “The students don’t see the money unless the loan given covers more than they owe to the school.”

Smith credits irresponsible borrowing as one of the reasons student debt has skyrocketed recently.

The venture is a personal financial risk for Dash and his co-founders, who will not collect a salary unless they are successful in their venture. Any money earned will come through a commission from the private lenders with no expense passed on to those who signed the petition.

Dash has a long resume in financial services, including JP Morgan and Venture Capital. After spending the last few years following consumer movements in other parts of the world, Dash decided to attempt the concept in America.

“This is quite an ambitious project. To get the support from 100,000 people requires people to embrace in the concept,” Dash said. “Th is is the first consumer movement of its kind in the U.S. and the first for student debt in the world.”

In the first week, over 22,000 people signed up as part of the campaign, which extends through April 4. At the time of publication 25,649 people had signed the pledge.

All JoinStampede requires to sign the petition is a name and email address. The offer negotiated with the private lenders will be exclusively offered to those who signed the pledge.

Dash anticipates negotiating with lenders for two weeks after the petition closes on April 4, with results returned to the consumers within six months.

“Our own expectation for the most likely outcome is that we will be able to help those with existing private debt,” Dash said. “We want to be the voice that represents consumers and improve the student voice.”

Long-term goals for JoinStampede include helping consumers in other ways by possibly negotiating similar deals with mortgage brokers.

JoinStampede is active on social media and has a page on causes.com, a popular website for distributing campaigns and petitions.

“This captures people’s imagination – what is the potential of crowd-sourcing?,” Dash said. “[By] using people power and different ways of thinking there are many more options of what we can achieve.”

Comments